Trap Strategy

- Trades only in S&P 500 and Nasdaq100 indices

- Long Short Strategy

- Leverage 3 Times

- Strategy is 100% objective and rule-based

- Position sizing and money-management rules are in-built

- System is design to take advantage of Market Traps (Trading psychology)

- Take advantage of Behavior Patterns (Bull Trap/ Bear Trap)

- Significantly outperforms in all the bear market scenario

- Results since May’12 with steady Equity Curve

Strategy Statistics (Leverage 3 times) |

| All trades |

| Long trades | Short trades | |

Initial capital | 100000.00 |

| 100000.00 | 100000.00 | |

Ending capital | 2366265.28 |

| 2076665.68 | 389599.60 | |

Net Profit | 2266265.28 |

| 1976665.68 | 289599.60 | |

Net Profit % | 2266.27% |

| 1976.67% | 289.60% | |

Exposure % | 40.11% |

| 25.94% | 14.17% | |

Net Risk Adjusted Return % | 5650.21% |

| 7620.81% | 2043.51% | |

Annual Return % | 37.97% |

| 36.15% | 14.84% | |

Risk Adjusted Return % | 94.66% |

| 139.37% | 104.70% | |

Transaction costs | 652729.90 |

| 360666.32 | 292063.58 | |

| |||||

All trades | 679 |

| 377 (55.52 %) | 302 (44.48 %) | |

Avg. Profit/Loss | 3337.65 |

| 5243.15 | 958.94 | |

Avg. Profit/Loss % | 0.34% |

| 0.57% | 0.06% | |

Avg. Bars Held | 1488.95 |

| 1730.23 | 1187.75 | |

| |||||

Winners | 284 (41.83 %) |

| 191 (28.13 %) | 93 (13.70 %) | |

Total Profit | 5337627.29 |

| 3467373.34 | 1870253.95 | |

Avg. Profit | 18794.46 |

| 18153.79 | 20110.26 | |

Avg. Profit % | 1.85% |

| 1.85% | 1.86% | |

Avg. Bars Held | 2384.11 |

| 2582.03 | 1977.61 | |

Max. Consecutive | 10 |

| 11 | 5 | |

Largest win | 177781.49 |

| 148094.95 | 177781.49 | |

# bars in largest win | 3515 |

| 2724 | 3515 | |

| |||||

Losers | 395 (58.17 %) |

| 186 (27.39 %) | 209 (30.78 %) | |

Total Loss | -3071362.01 |

| -1490707.66 | -1580654.35 | |

Avg. Loss | -7775.60 |

| -8014.56 | -7562.94 | |

Avg. Loss % | -0.74% |

| -0.76% | -0.73% | |

Avg. Bars Held | 845.34 |

| 855.52 | 836.28 | |

Max. Consecutive | 9 |

| 8 | 16 | |

Largest loss | -82261.00 |

| -82261.00 | -47561.22 | |

# bars in largest loss | 461 |

| 461 | 394 | |

| |||||

Max. trade drawdown | -259573.53 |

| -96421.06 | -259573.53 | |

Max. trade % drawdown | -6.82 |

| -5.69 | -6.82 | |

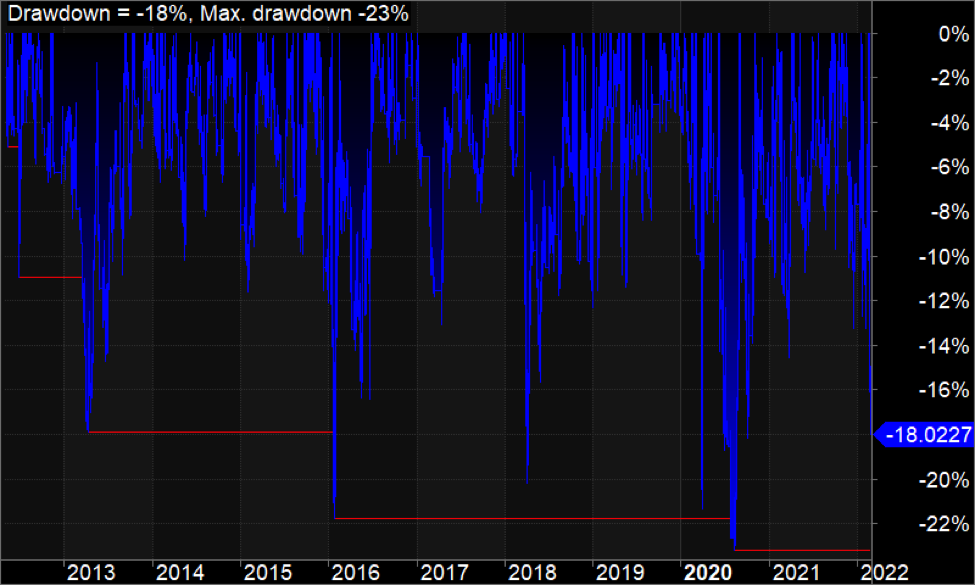

Max. system drawdown | -520221.35 |

| -195384.27 | -594835.60 | |

Max. system % drawdown | -23.16% |

| -20.70% | -99.95% | |

Recovery Factor | 4.36 |

| 10.12 | 0.49 | |

CAR/MaxDD | 1.64 |

| 1.75 | 0.15 | |

RAR/MaxDD | 4.09 |

| 6.73 | 1.05 | |

Profit Factor | 1.74 |

| 2.33 | 1.18 | |

Payoff Ratio | 2.42 |

| 2.27 | 2.66 | |

Standard Error | 265424.46 |

| 245874.65 | 83922.67 | |

Risk-Reward Ratio | 0.65 |

| 0.65 | 0.13 | |

Ulcer Index | 7.03 |

| 4.57 | 44.33 | |

Ulcer Performance Index | 4.63 |

| 6.72 | 0.21 | |

Sharpe Ratio of trades | 1.26 |

| 1.99 | 0.02 | |

Portfolio Equity

Underwater Equity

Profit Table

Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Yr% |

2012 | N/A | N/A | N/A | N/A | 3.6% | 1.8% | 24.4% | -1.6% | 3.8% | -1.5% | 6.7% | 0.8% | 41.9% |

2013 | 1.2% | -3.6% | -3.5% | -3.7% | 3.4% | -2.2% | 6.7% | -1.3% | 8.4% | 12.9% | 2.7% | 1.5% | 23.2% |

2014 | 3.1% | 12.7% | -3.3% | -0.1% | 4.5% | 0.7% | -3.0% | 4.1% | -3.5% | 9.7% | 1.1% | 1.3% | 29.4% |

2015 | 4.6% | -3.8% | 11.1% | 1.7% | -1.9% | -2.3% | 7.1% | -5.0% | 9.7% | 16.6% | 6.5% | -9.5% | 36.7% |

2016 | -9.8% | 16.2% | 0.6% | -1.8% | 2.6% | 8.0% | 3.2% | -2.5% | 7.1% | 0.5% | 4.5% | -1.0% | 28.5% |

2017 | -0.8% | -0.7% | -5.7% | 7.1% | 0.5% | 0.8% | 9.0% | -3.4% | -0.1% | 4.6% | 4.5% | 2.5% | 18.7% |

2018 | 2.6% | 11.0% | -4.3% | 2.0% | -6.3% | 5.8% | 3.6% | 2.0% | -0.5% | -2.0% | 10.9% | -1.7% | 23.7% |

2019 | 1.5% | 2.3% | 0.5% | 4.6% | 3.2% | 11.7% | -1.7% | 1.0% | 4.5% | 6.3% | 1.7% | 7.3% | 51.6% |

2020 | 0.5% | 13.9% | 7.7% | 14.8% | -3.8% | -1.6% | -5.7% | 10.9% | 7.7% | 3.6% | 16.8% | 0.4% | 83.0% |

2021 | -0.4% | 3.5% | -10.6% | 12.7% | -2.7% | 3.3% | 2.1% | -2.0% | 13.5% | 2.2% | 2.8% | 0.3% | 24.8% |

2022 | 14.4% | 5.0% | -2.5% | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 17.1% |

Avg | 1.7% | 5.6% | -1.0% | 4.1% | 0.3% | 2.6% | 4.6% | 0.2% | 5.1% | 5.3% | 5.8% | 0.2% |